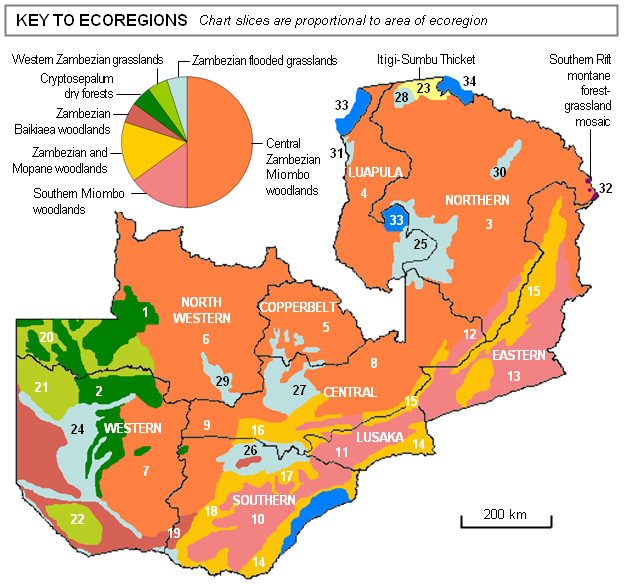

Zambian map (commons.wikimedia.org Pic)

The precious stones miner is concerned Zambia’s ban on overseas auctioning of gemstones will hurt revenue at its core Kagem emerald mine.

Monday , 08 Apr 2013 (Reuters) –

Precious stones miner Gemfields Plc said Zambia government’s ban on overseas auctioning of gemstones would hurt revenue at its core Kagem emerald mine in north Zambia, sending its shares down as much as 27 percent.

The Zambian Ministry of Mines, Energy and Water Development directed on Friday that all auctioning of emeralds be held in Zambia as their sale in foreign markets contributes to capital flight.

« We expect the ban to enhance transparency and eliminate middlemen, » Mines, Energy and Water Development Minister Yamfwa Mukanga said during a news conference in the Zambian capital, Lusaka, on Friday.

S.P. Angel analyst Carole Ferguson, however, said Zambia was trying to flex its muscles.

« It’s just a matter of negotiating with the government – I don’t see how the government could realistically expect them (Gemfields) to have all the auctions in Zambia and generate the type of revenue they’re generating, » Ferguson told Reuters.

Gemfields, owner of the Fabergé luxury jewellery brand, said it would host an auction in Lusaka this month and that its next foreign auction was scheduled to take place in Singapore in June.

The company, which named actress Mila Kunis as its brand ambassador earlier this year, mines mainly emeralds at its 75 percent-owned Kagem mine, but also has interests in ruby and sapphire deposits.

Output from Kagem has been sold solely outside the country since 2009, generating $160 million of revenue from 11 auctions abroad.

Kagem generated revenue of $77.6 million in 2012, compared with $8.8 million in 2008 when Gemfields bought the mine.

The ban would also affect Gemfields’ Kariba amethyst mine in south Zambia, in which the company has a 50 percent stake, it said.

Gemfields’ shares were down 18 percent at 24.3 pence on the London Stock Exchange at 1255 GMT on Monday.